Professional CPF application assistance for foreigners moving to Brazil

Introduction

Moving to Brazil for work, study, business, or love? There’s one essential document that will unlock virtually every aspect of Brazilian life: the CPF (Cadastro de Pessoas Físicas). Whether you’re planning to open a bank account, buy property, start a business, or even purchase a simple SIM card for your phone, you’ll need this crucial Brazilian tax identification number.

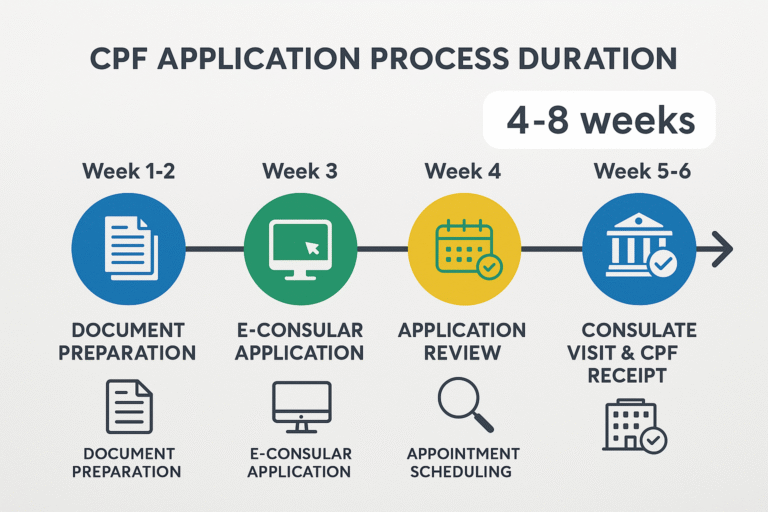

Complete CPF application timeline: 4-8 weeks from start to finish

The CPF application process for foreigners has undergone significant changes in recent years, particularly with the implementation of Law No. 14.534 in January 2023, which made CPF mandatory for all public service requests. What was once a straightforward online process now requires careful preparation and an in-person appointment at a Brazilian consulate or embassy.

This comprehensive guide provides everything you need to know about obtaining your CPF as a foreigner, including a complete checklist of required documents, step-by-step instructions for the application process, and insider tips to avoid common pitfalls that could delay your application. We’ve analyzed the latest government regulations, consulted official sources from the Brazilian Ministry of Foreign Affairs and Federal Revenue Service, and compiled real-world experiences from successful applicants to bring you the most accurate and up-to-date information available.

By the end of this guide, you’ll have a clear roadmap for obtaining your CPF efficiently and correctly the first time. We’ve also prepared a downloadable checklist that you can use to track your progress and ensure you don’t miss any critical steps in the process.

What is a CPF and Why Do Foreigners Need It?

The CPF (Cadastro de Pessoas Físicas) is Brazil’s national taxpayer identification system, managed by the Brazilian Federal Revenue Service (Receita Federal do Brasil). Think of it as Brazil’s equivalent to a Social Security Number in the United States or a National Insurance Number in the United Kingdom. This 11-digit number serves as your unique identifier in Brazil’s financial and administrative systems.

Unlike many other countries where tax identification numbers are primarily reserved for citizens and permanent residents, Brazil’s CPF system is remarkably inclusive. The database contains cadastral information for both Brazilian and foreign individuals, whether they reside in Brazil or not. This accessibility makes it possible for foreigners to participate fully in Brazil’s economy and society, even before establishing permanent residency.

The Legal Framework: Why CPF Became Mandatory

The importance of CPF for foreigners was significantly amplified with the passage of Law No. 14.534 on January 11, 2023. This legislation mandated that all public service request forms must include a CPF field as mandatory information. The law’s implementation means that virtually any interaction with Brazilian government services now requires a valid CPF number.

The Brazilian government’s rationale for this requirement centers on improving administrative efficiency, reducing fraud, and ensuring better tracking of financial transactions. For foreigners, this change transformed the CPF from a “nice-to-have” convenience into an absolute necessity for anyone planning to engage with Brazilian institutions.

Practical Applications: Where You’ll Need Your CPF

The scope of CPF usage in Brazil extends far beyond tax filing. As a foreigner, you’ll encounter CPF requirements in numerous everyday situations that might surprise you. Understanding these applications helps illustrate why obtaining your CPF should be among your first priorities when planning your Brazilian journey.

Financial Services and Banking

Opening a bank account in Brazil is virtually impossible without a CPF. Brazilian banks are required by law to collect CPF information for all account holders, including foreigners. This requirement extends to investment accounts, credit cards, loans, and even basic savings accounts. Major banks like Banco do Brasil, Itaú, Bradesco, and Caixa Econômica Federal all require CPF for account opening.

Real Estate Transactions

Whether you’re buying, selling, or renting property in Brazil, your CPF will be required for all legal documentation. Property registration, utility connections, and rental agreements all mandate CPF inclusion. Foreign property investors particularly need to understand that without a CPF, they cannot legally complete property purchases or register ownership with Brazilian authorities.

Business Operations

Starting a business in Brazil requires a CPF for the business owner or legal representative. This applies to everything from small sole proprietorships to large corporate investments. The CPF is used to register with various business authorities, obtain necessary licenses, and comply with tax obligations. Foreign entrepreneurs cannot establish legal business entities without this identification number.

Educational Enrollment

Universities and educational institutions in Brazil require CPF for student registration, even for international students. This requirement applies to both undergraduate and graduate programs, as well as professional certification courses. Without a CPF, foreign students cannot complete their enrollment process or access student services.

Utility Services and Contracts

Setting up basic services like electricity, water, gas, internet, and mobile phone contracts requires CPF verification. Utility companies use CPF numbers to establish customer accounts, process payments, and maintain service records. This requirement often catches foreigners off-guard when they attempt to establish basic household services.

Online Commerce and Digital Services

Brazil’s e-commerce sector extensively uses CPF for customer verification. Major online retailers, digital payment platforms, and subscription services require CPF for account creation and transaction processing. This includes popular services like Mercado Livre (Brazil’s equivalent to Amazon), digital banks like Nubank, and streaming services.

Healthcare and Insurance

While emergency medical care is available through Brazil’s public health system (SUS) without CPF, accessing comprehensive healthcare services, private insurance, and specialized treatments typically requires CPF registration. Private healthcare providers use CPF for patient identification and billing purposes.

The Digital Integration Factor

Brazil has embraced digital government services more extensively than many other countries, with initiatives like the gov.br platform centralizing access to numerous public services. This digital transformation has made CPF even more critical, as it serves as the primary authentication method for accessing online government services. Foreign residents and temporary visitors who need to interact with Brazilian digital services find CPF indispensable for navigation and access.

The integration extends to Brazil’s increasingly cashless economy. Digital payment systems like PIX (Brazil’s instant payment system) rely heavily on CPF for user identification and transaction processing. As Brazil continues to digitize its financial infrastructure, having a CPF becomes essential for participating in the modern Brazilian economy.

Understanding these extensive applications helps explain why the CPF application process, while requiring some effort and preparation, represents a crucial investment in your Brazilian experience. The time spent obtaining your CPF will pay dividends in smoother interactions with Brazilian institutions and services throughout your stay.

Who Needs to Apply for a CPF?

While not every foreigner visiting Brazil requires a CPF, understanding the specific circumstances that make CPF mandatory or highly recommended will help you determine your application priority. The Brazilian Federal Revenue Service has established clear guidelines about CPF obligations, though the practical reality often extends beyond these formal requirements.

Mandatory CPF Requirements for Foreigners

According to Article 4 of Normative Instruction RFB No. 2.172/2024, certain categories of individuals are legally obligated to obtain CPF registration. For foreigners, these mandatory situations include:

- Income Earners in Brazil: Any foreigner who receives income from Brazilian sources must obtain a CPF. This includes employment income, business profits, rental income from Brazilian properties, investment returns, and freelance payments. The obligation applies regardless of the amount earned or the duration of the income-generating activity. Even short-term consulting work or temporary employment triggers this requirement.

- Property Owners: Foreigners who own real estate in Brazil are required to have CPF registration. This obligation extends beyond the initial purchase to ongoing ownership responsibilities, including property tax payments and potential rental income reporting. The requirement applies to all types of real property, including residential, commercial, and agricultural land.

- Business Owners and Investors: Foreign individuals who establish businesses in Brazil, hold ownership stakes in Brazilian companies, or make significant investments in Brazilian markets must obtain CPF. This includes both active business management roles and passive investment positions. The threshold for “significant” investment is not precisely defined, but any formal business registration or investment that generates tax obligations triggers the CPF requirement.

- Government Benefit Recipients: Foreigners who receive any form of government assistance, social benefits, or participate in government programs must have CPF registration. This includes educational grants, social assistance programs, and any other government-sponsored benefits.

- Tax Obligation Triggers: Any situation that creates Brazilian tax obligations automatically requires CPF registration. This can include inheritance of Brazilian assets, gifts received from Brazilian sources, or participation in Brazilian financial markets beyond basic tourism activities.

Highly Recommended Situations

Beyond mandatory requirements, numerous situations make CPF registration highly advisable for foreigners, even when not legally required:

- Extended Stay Visitors: Foreigners planning to stay in Brazil for more than a few months will find CPF essential for practical daily life. While tourist activities might not legally require CPF, extended stays inevitably involve situations where CPF becomes necessary for convenience and access to services, as cheaper internet services.

- Students and Researchers: International students, even those on temporary study visas, benefit significantly from CPF registration. Universities increasingly require CPF for enrollment processes, student services access, and integration with Brazilian educational systems. Research collaborations, academic employment, and student housing often necessitate CPF.

- Spouses of Brazilian Citizens: Foreign spouses of Brazilian citizens should prioritize CPF registration, as it facilitates numerous aspects of family life in Brazil. Joint financial accounts, property purchases, family business involvement, and access to spousal benefits often require CPF documentation.

- Frequent Business Travelers: Foreigners who regularly travel to Brazil for business purposes, even without establishing permanent operations, find CPF valuable for streamlining business activities. Recurring business relationships, contract negotiations, and professional service engagements are simplified with CPF registration.

- Digital Nomads and Remote Workers: The growing community of digital nomads choosing Brazil as a base increasingly needs CPF for accessing local services, establishing temporary residency arrangements, and integrating with Brazil’s digital economy.

Special Circumstances and Considerations

- Minors and Dependents: Foreign minors can obtain CPF registration, which is often beneficial for families relocating to Brazil. Parents or legal guardians can apply on behalf of minors, and having CPF registration for children simplifies school enrollment, healthcare access, and family financial planning.

- Diplomatic and Consular Staff: Foreign diplomatic personnel and their families have specific CPF application procedures that differ from standard processes. These individuals should consult with their diplomatic missions and Brazilian authorities for appropriate guidance.

- Temporary Work Visa Holders: Foreigners on temporary work visas, including those in specialized professional categories, typically need CPF for employment authorization and tax compliance. The temporary nature of the visa does not eliminate CPF requirements for work-related activities.

- Investment Visa Recipients: Foreigners who obtain Brazilian residency through investment programs must have CPF registration as part of their investment compliance and ongoing residency maintenance requirements.

Timing Considerations

The timing of CPF application can significantly impact your Brazilian experience. Early application, even before traveling to Brazil, can streamline many processes upon arrival. However, some foreigners prefer to wait until they’re certain about their long-term plans in Brazil.

- Pre-Arrival Application: Applying for CPF before traveling to Brazil allows you to hit the ground running with bank account opening, housing arrangements, and service connections. This approach requires careful planning and document preparation but can save significant time and frustration upon arrival.

- Post-Arrival Application: Some foreigners prefer to apply after arriving in Brazil, allowing them to better understand their specific needs and circumstances. This approach may involve some initial inconveniences, but it provides more certainty about the necessity and urgency of CPF registration.

The decision about when to apply should consider your specific circumstances, planned activities in Brazil, and tolerance for initial administrative challenges. Regardless of timing, understanding your CPF obligations and preparing accordingly will contribute to a smoother Brazilian experience.

Complete CPF Application Checklist for Foreigners

This comprehensive checklist serves as your complete roadmap for CPF application success. We’ve organized it into three critical phases: document preparation, application submission, and appointment completion. Each item includes specific requirements and common pitfalls to avoid.

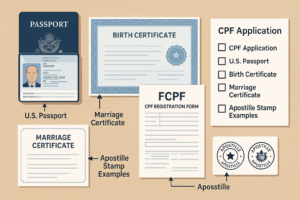

Essential documents needed for CPF application: passport, birth certificate, CPF form, and apostille stamps

Phase 1: Document Preparation Checklist

The document preparation phase is where most applications succeed or fail. Brazilian authorities are strict about document requirements, and missing or incorrect documentation will result in application rejection or significant delays.

Core Required Documents

CPF Registration Form (FCPF)

- Download the official form from the Brazilian Federal Revenue Service website

- Complete all fields accurately in Portuguese or English

- Ensure handwriting is legible if completing by hand

- Sign and date the form

- Common mistake: Using outdated form versions – always download the current version

- Complete the form digitally when possible to avoid handwriting issues

Valid Passport

- Must be current and valid for at least 6 months beyond application date

- Include all pages showing personal information, photo, and entry stamps

- Ensure photo clearly shows your face and matches current appearance

- Document format: High-resolution scan in PDF or JPEG format

- Common mistake: Submitting expired or soon-to-expire passports

- If your passport expires soon, renew it before applying for CPF

Birth Certificate

- Must show full name, date of birth, place of birth, and parents’ names

- Required if the passport doesn’t contain complete birth information

- Must be an official government-issued document

- Special requirement: If issued outside it must be apostilled or legalized

- Common mistake: Submitting hospital birth certificates instead of official government certificates

- Order multiple certified copies if you anticipate needing them for other Brazilian processes

Marriage Certificate (if applicable)

- Required only if you’ve changed your name due to marriage

- Must show both maiden and married names

- Must be apostilled or legalized if issued outside Brazil

- Common mistake: Forgetting to include marriage certificate when name change occurred

- Include marriage certificate even if name change seems obvious from other documents

Additional Documents for Special Circumstances

For Minors Under 16 Years

- Birth certificate or official photo ID of the minor

- Valid photo ID of parent or legal guardian

- Document proving guardianship, custody, or parental rights

- Special note: Both parent and minor must attend the consulate appointment

- Common mistake: Assuming one parent can apply without the minor present

For Applicants 16-17 Years Old

- If applying independently: photo ID showing nationality, parentage, and birth date

- If parent/guardian applying: birth certificate plus photo IDs of both applicant and parent/guardian

- 16-17 year olds can apply independently, but may find the process easier with parental assistance

For Diplomatic Personnel

- Official photo ID proving nationality and birth date

- Birth certificate or equivalent if information not included in official ID

- Diplomatic credentials or employment verification

- Diplomatic personnel may have expedited processing options

Document Legalization and Apostille Requirements

Understanding document legalization requirements is crucial for international applicants. The process varies significantly depending on your country of origin and the specific documents involved.

Apostille Process (for Hague Convention countries)

- Verify your country participates in the Hague Apostille Convention

- Obtain apostille from designated authority in your country

- Ensure apostille covers all required documents

- Allow 2-4 weeks for apostille processing

- Attempting to apostille documents in the wrong country

Consular Legalization (for non-Hague Convention countries)

- Contact Brazilian consulate in your country for specific requirements

- May require multiple steps including local authentication and consular verification

- Allow 4-8 weeks for complete legalization process

- Start legalization process early as it’s often the longest part of the preparation

Translation Requirements

- Documents in languages other than Portuguese may require certified translation

- Use only certified translators approved by Brazilian authorities

- Include both original and translated versions in your application

- Common mistake: Using non-certified translations or online translation services

Phase 2: Digital Application Preparation Checklist

The e-consular system requires careful preparation and attention to detail. Technical issues and formatting problems can delay your application significantly.

E-consular Account Setup

- Visit the official e-consular website

- Select your country from the dropdown

- Choose the correct Brazilian consulate for your jurisdiction

- Create account with valid email address and strong password

- Use an email address you check regularly, as all communications will come through this channel

Jurisdiction Verification

- Confirm which Brazilian consulate serves your residential area

- Verify consulate contact information and service hours

- Check for any special requirements or procedures for your specific consulate

- Common mistake: Applying to the wrong consulate based on travel convenience rather than residential jurisdiction

Document Digitization

- Scan all documents at high resolution (minimum 300 DPI)

- Save files in PDF or JPEG format only

- Ensure file sizes meet system requirements (typically under 5MB per file), You can use a free platform to do it.

- Create a dedicated folder on your computer for all CPF-related documents

Phase 3: Appointment and Completion Checklist

The in-person appointment is the final critical step in your CPF application process. Proper preparation ensures smooth completion and immediate CPF issuance.

Appointment Scheduling

- Wait for application approval email before attempting to schedule

- Book appointment as soon as approval is received (slots fill quickly)

- Choose appointment time that allows for potential delays

- Confirm appointment 24-48 hours in advance

- Book morning appointments when possible as consulate staff are typically less rushed

Appointment Preparation

- Print the completed application form with QR code

- Organize all original documents in order of application requirements

- Bring photocopies of all documents as backup

- Arrive 15-30 minutes early for security processing

- Common mistake: Bringing only digital copies instead of original documents

What to Bring to Your Appointment

- Printed application form with QR code

- Original passport

- Original birth certificate

- Original marriage certificate (if applicable)

- Any additional documents specific to your situation

- Valid photo ID as backup

Appointment Day Expectations

- Allow 2-3 hours for the complete process, including wait time

- Dress professionally and appropriately for a government office

- Be prepared to answer questions about your application

- Common mistake: Underestimating time requirements and scheduling conflicting appointments

Post-Appointment Follow-up

- Verify all information on your CPF documentation before leaving

- Ask about the processing time for any additional steps

- Request contact information for follow-up questions

- Keep all documentation provided by the consulate

- Take a photo of your CPF number immediately for your records

Alternative Application Methods

While the e-consular system is the primary method for foreigners abroad, alternative options exist for specific circumstances.

In-Person Application in Brazil

Foreigners already in Brazil can apply directly at Federal Revenue Service offices, authorized banks (Banco do Brasil, Caixa Econômica Federal), post offices (Correios), or authorized notary offices. This method typically provides same-day service but requires legal presence in Brazil.

Attorney Representation

Some foreigners choose to hire Brazilian attorneys or specialized service providers to handle their CPF application. This option can be valuable for complex situations, but it involves additional costs and requires careful selection of qualified representatives.

Expedited Processing

While standard processing times are generally consistent, some consulates may offer expedited services for urgent business or emergency situations. Contact your consulate directly or a specialized service providers to inquire about expedited options and associated requirements.

After Getting Your CPF: Next Steps

Receiving your CPF number marks the beginning of your integration into Brazil’s administrative and financial systems. Understanding how to use and maintain your CPF ensures you can take full advantage of the opportunities it provides.

Immediate Verification and Documentation

- CPF Status Verification: Your first step should be verifying your CPF status through the Federal Revenue Service website. Visit the official consultation portal and enter your CPF number to confirm it’s active and properly registered in the system.

- Document Organization: Create both physical and digital copies of your CPF documentation. Store original documents securely and maintain easily accessible copies for routine use. Consider creating a dedicated folder for all Brazil-related documentation.

- Number Memorization: Your CPF number will be requested frequently in Brazil, so memorize it as you would a phone number. The 11-digit format (XXX.XXX.XXX-XX) becomes second nature with regular use.

Banking and Financial Services – Best Bank in Brazil for foreigners

- Bank Account Opening: With your CPF, you can now open Brazilian bank accounts. Research different banks to find options that cater to foreigners and offer services in English if needed. Major banks like Itaú, Bradesco, and Banco do Brasil have international departments specifically for foreign customers.

- Digital Banking Setup: Brazil’s digital banking sector is highly advanced. Consider opening accounts with digital banks like Nubank, Inter, or C6 Bank, which often have streamlined processes for foreigners and excellent mobile applications.

- Investment Opportunities: Your CPF enables participation in Brazilian investment markets, including stocks, bonds, and real estate investment trusts (REITs). Research investment options and consider consulting with Brazilian financial advisors familiar with foreign investor needs.

Tax Obligations and Compliance

- Understanding Tax Responsibilities: Having a CPF may create Brazilian tax obligations depending on your activities and income sources.

- Annual Declaration Requirements: If you meet certain income or asset thresholds, you may need to file annual tax declarations in Brazil. Understanding these requirements early helps avoid compliance issues later.

- Record Keeping: Maintain detailed records of all Brazilian financial activities, as these may be required for tax reporting in both Brazil and your home country.

Consult us to obtain advice from Brazilian tax professionals and understand your specific obligations and compliance requirements.

Practical Applications and Services

- Utility Services: Use your CPF to establish utility accounts for electricity, water, gas, internet, and mobile phone services. Having CPF streamlines these processes significantly compared to alternatives available to tourists.

- Healthcare Access: While emergency care is available through Brazil’s public system (SUS) without CPF, having the number improves access to comprehensive healthcare services and private insurance options.

- Educational Opportunities: Your CPF enables enrollment in Brazilian educational institutions, from language schools to universities. Research educational opportunities that align with your goals and interests.

Maintaining Your CPF

- Address Updates: If you change your address in Brazil or internationally, update your CPF registration to maintain accurate records. This can typically be done online through the Federal Revenue Service website.

- Status Monitoring: Periodically check your CPF status to ensure it remains active and in good standing. Address any issues promptly to avoid complications with Brazilian services.

- Document Renewal: While your CPF number is permanent, keep associated documentation current. Update passport information and other details as needed to maintain accurate records.

Frequently Asked Questions – FAQ

Q: Can I apply for CPF completely online without visiting a consulate?

No, current regulations require an in-person appointment at a Brazilian consulate or embassy for foreigners applying from abroad. The online e-consular system is used for application preparation and appointment scheduling, but document verification must be completed in person.

Q: How long is my CPF valid?

Your CPF number is permanent and does not expire. However, your CPF status can change based on your activities and compliance with Brazilian regulations. Inactive CPF numbers may be suspended if not used for extended periods, but they can typically be reactivated when needed.

Q: Can I get a CPF if I’m just visiting Brazil as a tourist?

While not prohibited, CPF is generally unnecessary for short-term tourism. However, if your tourist activities involve significant financial transactions, property rentals, or business activities, CPF may be beneficial or required.

Q: What happens if my CPF application is rejected?

Rejection typically occurs due to incomplete documentation, incorrect information, or failure to meet requirements. You can reapply after addressing the issues that caused rejection.

Q: Do I need to translate my documents into Portuguese?

Documents in English are generally accepted by Brazilian consulates in the United States. Documents in other languages typically require certified translation into Portuguese or English. Check with your specific consulate for language requirements.

Q: Can someone else apply for CPF on my behalf?

Yes, but only in specific circumstances such as applications for minors by parents/guardians or through legal power of attorney. The person applying on your behalf must provide additional documentation proving their authority to act for you.

Q: What if I make a mistake on my application?

Minor errors can often be corrected during the consulate appointment. Significant errors may require resubmitting your application.

Q: Can I expedite my CPF application for urgent business needs?

Some consulates may accommodate urgent requests, but expedited processing is not guaranteed. Contact your consulate directly to discuss urgent circumstances and potential solutions.

Q: Can I use my CPF for online purchases immediately?

Yes, once you receive your CPF number, you can use it for online purchases, service registrations, and other digital transactions in Brazil. The number becomes active immediately upon issuance.

Q: What should I do if I lose my CPF documentation?

You can obtain replacement CPF documentation through the Federal Revenue Service website or by visiting authorized service locations in Brazil. Your CPF number remains the same; you’re simply replacing the physical documentation.

Q: Do I need to notify Brazilian authorities if I move to a different country?

While not legally required to notify authorities of international moves, updating your address information helps maintain accurate records and ensures you receive important communications about your CPF status.

Q: Can my CPF be cancelled or revoked?

CPF cancellation is rare and typically occurs only in cases of fraud, duplicate registrations, or specific legal circumstances. Legitimate CPF numbers remain valid indefinitely, though they may become inactive without regular use.

Conclusion

Obtaining your CPF as a foreigner represents a crucial step toward full participation in Brazilian society and economy. While the process has become more complex since 2023, requiring careful preparation and in-person verification, the benefits far outweigh the administrative effort involved.

This comprehensive guide has provided you with everything needed to navigate the CPF application process successfully. From understanding who needs CPF and why, to completing the detailed checklist and avoiding common mistakes, you now have the knowledge and tools necessary for application success.

The key to CPF application success lies in thorough preparation, attention to detail, and patience with the bureaucratic process. Start early, organize your documents carefully, and follow each step methodically. Remember that the time invested in obtaining your CPF will pay dividends throughout your Brazilian experience, opening doors to banking, business, education, and countless other opportunities.

Need Professional Assistance?

InfoFinderBrazil specializes in helping foreigners navigate Brazilian bureaucracy efficiently and effectively. Our experienced team provides comprehensive CPF application assistance, document preparation services, and ongoing support for all your Brazilian administrative needs. From initial consultation to CPF receipt, we ensure your application process is smooth, accurate, and successful.